nc sales tax on prepared food

Those are taxed with the 475 state sales tax in addition to the local sales tax of 2 to 225 as of April 2019 so the rate can be as high as. Many municipalities exempt or charge special sales tax rates to certain types of transactions.

Deductions For Sales Tax Turbotax Tax Tips Videos

Prescription Drugs are exempt from the North Carolina sales tax.

. Gross receipts derived from sales of food non-qualifying food and prepaid meal plans and the applicable sales and use tax thereon are to be reported to the Department on Form E-500 Sales and Use Tax Return or through the. A bundled transaction that includes a prepaid meal plan is taxable in accordance with NC. The second factor is the nature of the food item being sold.

Does nc have sales tax on food. In addition to the requirements outlined by the Business Privilege License Office all food vendors must comply with regulations determined by the Charlotte-Mecklenburg Department of Environmental Health and the City of Charlotte Fire Department. The tax is only imposed by local jurisdictions upon the granting of approval by the North Carolina General AssemblyThe provision is found in GS.

Municipal governments in North Carolina are also allowed to collect a local-option sales tax that ranges from 2 to 275 across the state with an average local tax of 222 for a total of 697 when combined with the state sales tax. Walk-ins and appointment information. This general rate applies to food prepared and consumed on the premises of full service restaurants and other retail establishments such as taverns and fast food shops that.

While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Its 9 on sales of prepared and restaurant meals and 10 on alcoholic beverages served in restaurants. This tax is collected by the merchant in addition to NC State Sales Tax and.

Considered prepared meals or food and would be eligible food exempt from the state sales and use tax under South Carolina Code 12-36-212075 provided it is not one of the foods listed above in SC Regulation 117-3371B Items 1. Nc sales tax on food items. Counties and cities in north carolina are allowed to charge an additional local sales tax on top of the north carolina state sales tax.

105-164328 and reads as follows. 75 is the highest possible tax rate cedar grove north carolina the average combined rate of every zip code in north. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 75.

Prepared food in a. Food Alcohol Sales. GET THE LATEST INFORMATION Most Service Centers are now open to the public for walk-in traffic on a limited schedule.

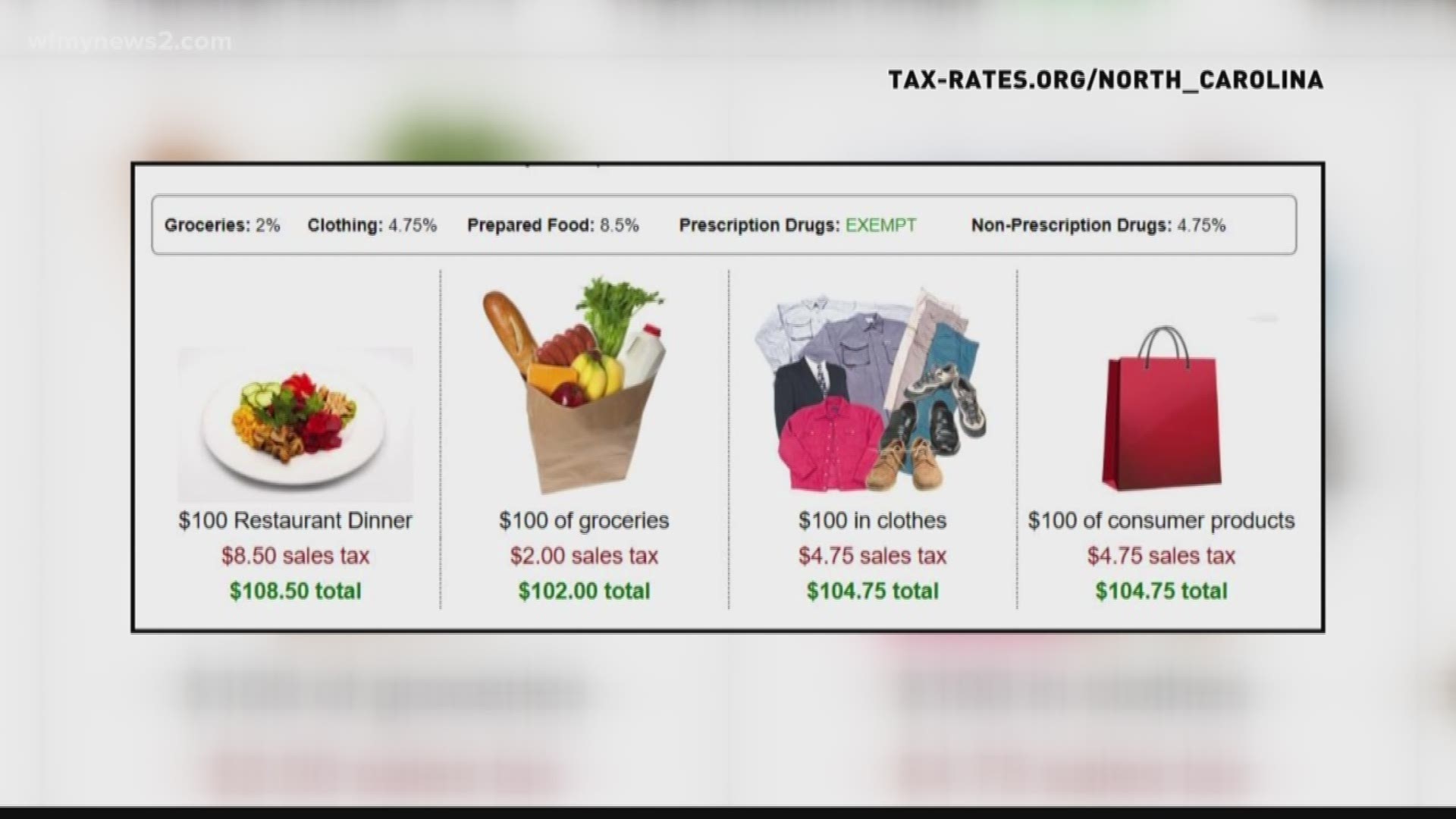

Read more about the Vermont Meals Rooms tax here. Appointments are recommended and walk-ins are first come first serve. Groceries and prepared food are subject to special sales tax rates under North Carolina law.

Vermont Vermont has something called the Meals Rooms tax that applies to prepared foods. Certain purchases including alcohol cigarettes and gasoline may be subject to additional North Carolina state excise taxes in addition to the sales tax. This tax is in addition to State and local sales tax.

And 2 food where plates bowls glasses or cups are necessary to receive the food. North Carolina has 1012 special sales tax jurisdictions with local sales taxes in. The Food and Beverage tax rate for Dare County is 1 of the sales price of prepared foods and beverages sold within the county for consumption on or off a premises by a retailer who is subject to sales tax under GS.

This tax is in addition to the combined state and. Prepared Food and Beverage Return and Instructionspdf One percent 1 of the sales derived from prepared food and beverages sold is assessed at retail for consumption on or off the premises are assessed by any retailer within the County that is subject to sales tax imposed by the State of North Carolina. MEALS TAX One percent 1 of the sales price of prepared food beverages sold within the county for consumption on off the premises by a retailer subject to sales tax under this GS.

This tax is in addition to State and local sales tax. Prepared Meals Tax in North Carolina is a 1 tax that is imposed upon meals that are prepared at restaurants. But youd only charge the uniform reduced rate of 2 local tax on the loaf of bread.

Sales tax treatment of groceries candy soda as of july. Mecklenburg County Health Department 980 314-1620. According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7 475 NC state rate and 225 Cherokee County rate on the toothbrush and the candy.

A 1 tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises and applies to any retailer with sales in Cumberland County subject to sales tax imposed by the State of North Carolina under NCGS. To learn more see a full list of taxable and tax-exempt items in North Carolina. To-go orders that include both hot prepared items and cold items also tend.

The numerator includes sales of 1 prepared food if under a. Taxation of Food and Prepared Food NCDOR. The Article 43 half-cent Transit Tax and Article 46 quarter-cent county sales tax do not apply to food.

The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and beverages in restaurants. Virginia Sales of prepared foods are generally taxable in Virginia. A customer buys a toothbrush a bag of candy and a loaf of bread.

North Carolina has a statewide sales tax rate of 475 which has been in place since 1933. Food is exempt from the State portion of sales tax 475 but local sales taxes Articles 39 40 and 42 do apply to food to make up a 2 sales tax on food. North carolina defines prepared food as in part 1 food sold in a heated state or 2 food consisting of two or more foods mixed together by the retailer as a single item which does not require further cooking to prevent food borne illnesses or 3.

This page describes the taxability of food and meals in North Carolina including catering and grocery food. Most hot prepared food is subject to California sales tax whether consumed on premises currently impossible or to go. Of the definition of prepared food.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Prepared Food Beverage. This tax is applicable to all prepared food and beverages sold at retail for consumption on or off the premises by any retailer with sales in Wake County that are subject to sales tax imposed by the State under North Carolina General Statute NCGS 105-1644a1.

Of the prepared food definition at an establishment are more than 75 of the sellers total sales at the establishment. The maximum local tax rate allowed by North.

Washington Sales Tax For Restaurants Sales Tax Helper

Is Food Taxable In North Carolina Taxjar

Is Food Taxable In North Carolina Taxjar

Poha Is Popular Indian Breakfast Made With Flattened Rice That Is Tempered With Onion Curry Leaves And Mus Poha Recipe Indian Breakfast Rice Breakfast Recipes

Anexo Condados De Carolina Del Sur Upstate South Carolina County Map South Carolina

![]()

Prepared Food Beverage Tax Wake County Government

The Rules On Sales Taxes For Food Takeout And Delivery Cpa Practice Advisor

Everything You Need To Know About Restaurant Taxes

Pre Approved Vs Pre Qualified Letters Qualifications Lenders

Is Food Taxable In North Carolina Taxjar

Sales Tax On Grocery Items Taxjar

Sales Tax On Grocery Items Taxjar

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)